R&L Estate has long been regarded as a complex and carefully managed holding, often discussed but seldom fully understood. Whether viewed through the lens of property management, wealth preservation, or institutional stewardship, the estate represents a structured approach to assets that rewards careful study. This guide aims to provide a clear, methodical explanation of what defines R&L Estate, how it operates, and why it continues to attract attention from professionals and observers alike.

TLDR

R&L Estate is a structured and professionally managed estate built around long-term value, governance, and risk control. Its strength lies in diversified assets, clear legal frameworks, and disciplined oversight. Understanding its history, structure, and management principles provides insight into how complex estates function successfully over time.

Background and Origins

To understand R&L Estate, one must first consider its origins. Estates of this nature are rarely accidental; they are typically the result of deliberate planning spanning years or even decades. R&L Estate emerged from a combination of strategic land acquisition, capital investment, and legal foresight. Early decisions around ownership structures and asset allocation continue to influence its present form.

Over time, R&L Estate evolved from a consolidated holding into a diversified portfolio. This evolution reflects broader trends in estate management, particularly the shift away from single-asset dependence toward resilience through diversification. Such a trajectory often signals prudent leadership and long-term vision.

Core Assets and Portfolio Composition

The value of R&L Estate lies not only in its total worth but in the composition of its assets. While details may vary depending on the period under review, most analyses identify several core categories that define the estate:

- Real property, including residential, agricultural, and commercial holdings.

- Financial investments, such as equities, bonds, and private placements.

- Operational assets, which may include businesses or revenue-generating facilities.

- Intangible assets, including rights, leases, or intellectual property.

This layered structure reduces vulnerability to market volatility and helps ensure stable performance across economic cycles. From a professional standpoint, such balance is often considered a hallmark of competent estate administration.

Governance and Management Structure

One of the defining characteristics of R&L Estate is its governance framework. Rather than relying on informal oversight, the estate is managed through a clearly articulated structure that separates ownership, management, and advisory roles. This separation minimizes conflicts of interest and improves accountability.

Typically, governance includes:

- A trustee or board responsible for strategic decisions and fiduciary compliance.

- Professional managers handling daily operations and asset performance.

- External advisors providing legal, financial, and tax expertise.

This model aligns with best practices in estate and trust management, particularly for estates of significant value. It also ensures continuity, allowing the estate to function effectively beyond the tenure of any single individual.

Legal and Regulatory Foundations

No comprehensive guide to R&L Estate would be complete without addressing its legal foundation. Estates of this scale exist within a dense web of laws, regulations, and contractual obligations. Property law, tax law, and trust law all play central roles.

R&L Estate is structured to ensure compliance while maintaining flexibility. Legal instruments such as trusts, holding companies, and long-term leases are commonly used to protect assets and manage transfer across generations. Proper documentation and regular legal review are essential components of this framework.

Importantly, compliance is not treated as a one-time exercise. Instead, it is an ongoing process that adapts to regulatory changes, ensuring that the estate remains both lawful and efficient over time.

Financial Performance and Valuation

Assessing the financial performance of R&L Estate requires a disciplined approach. Valuation is influenced not only by market prices but also by income potential, maintenance costs, and long-term appreciation prospects. Regular, independent valuations help establish an accurate picture of the estate’s health.

Key performance indicators often include:

- Net operating income from properties and businesses.

- Capital appreciation of land and investments.

- Liquidity levels and debt exposure.

By monitoring these indicators, managers can make informed decisions that align with the estate’s long-term objectives rather than short-term gains.

Risk Management and Resilience

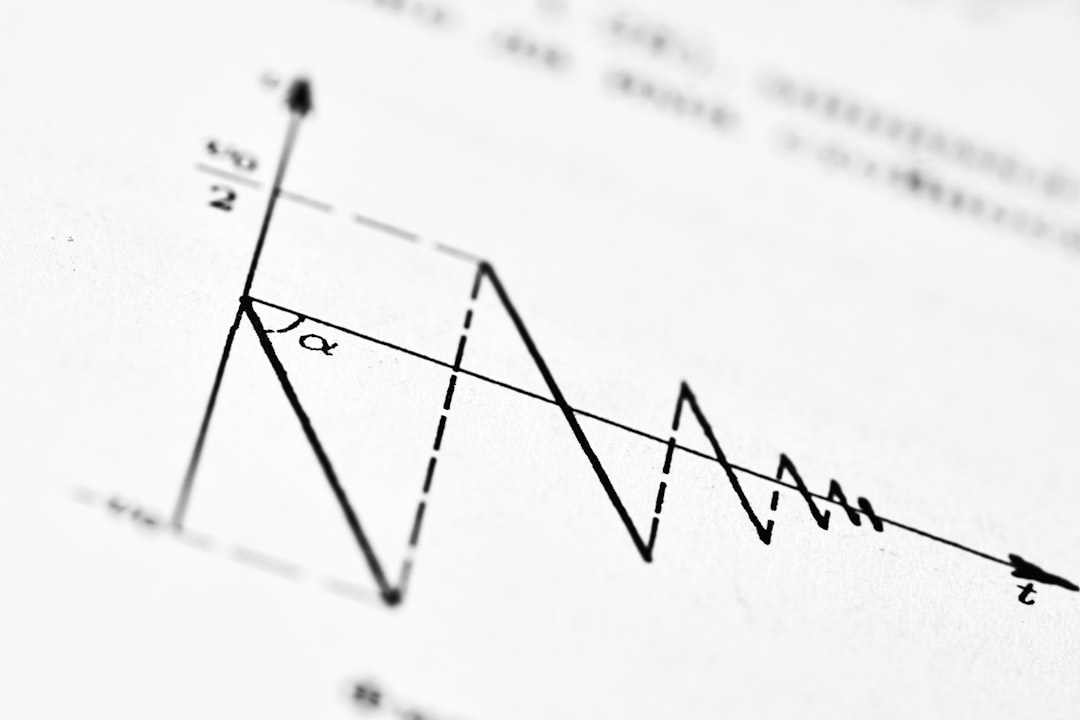

Every estate faces risk, and R&L Estate is no exception. What distinguishes it is the systematic way in which risks are identified, assessed, and mitigated. These risks may be financial, legal, environmental, or operational in nature.

Diversification, insurance coverage, and contingency planning form the foundation of its risk management strategy. In addition, scenario analysis is often used to test how the estate would respond to adverse conditions, such as economic downturns or regulatory changes.

This proactive stance enhances resilience and protects both current value and future potential.

Ethical and Stewardship Considerations

Beyond financial metrics, R&L Estate is frequently evaluated through the lens of stewardship. Responsible land use, fair employment practices, and community engagement are increasingly recognized as integral to sustainable estate management.

Ethical stewardship serves multiple purposes. It preserves reputation, reduces long-term liabilities, and aligns the estate with evolving societal expectations. In practice, this may involve environmental conservation efforts, transparent governance, and reinvestment in local infrastructure.

Succession and Long-Term Planning

Longevity is a defining ambition of R&L Estate. Succession planning ensures that leadership transitions do not disrupt operations or undermine value. Clear succession frameworks outline how decision-making authority is transferred and how beneficiaries are defined.

Education and preparation of future stewards play a critical role. By instilling principles of responsibility and discipline, the estate increases the likelihood that its core values will endure.

Conclusion

Unlocking the secrets of R&L Estate reveals not mystery, but method. Its success is grounded in structured governance, diversified assets, legal rigor, and a commitment to long-term stewardship. For those seeking to understand how complex estates operate and endure, R&L Estate offers a compelling and instructive example.

Ultimately, the estate stands as a reminder that sustainable value is rarely accidental. It is built through planning, oversight, and a disciplined respect for both assets and responsibilities.